Wager Mage

Wager Mage

Wager Mage

Wager Mage

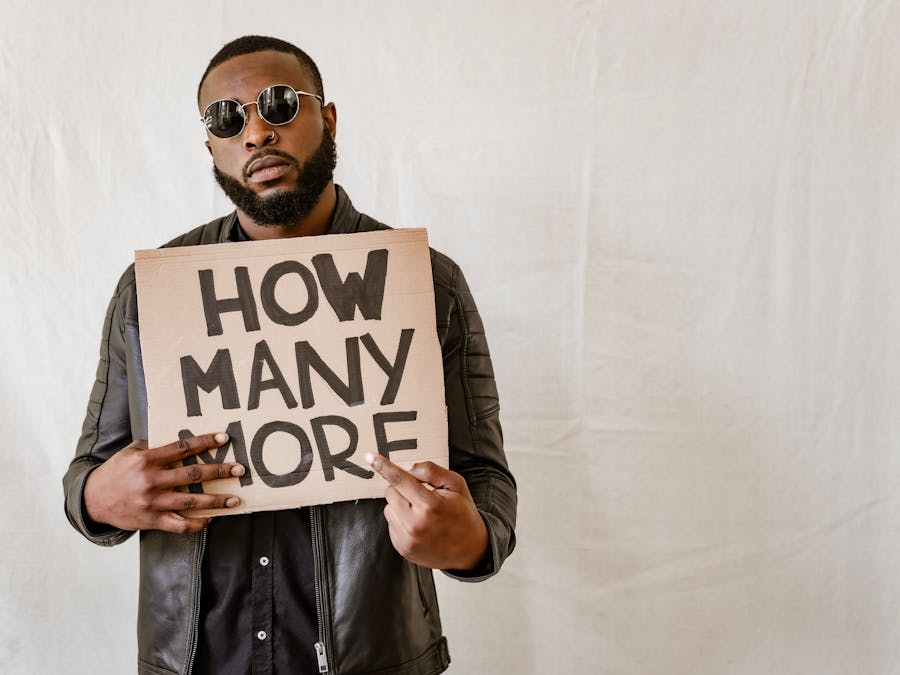

Photo: Andrea Piacquadio

Photo: Andrea Piacquadio

Many lenders require credit scores of 660 or higher for conventional loans, though you may be able to qualify with a score as low as 620. Freddie Mac Home Possible loans—conventional loans for owner-occupants that allow smaller down payments and lower income requirements—require a minimum credit score of 700.

The IRS has a computer system designed to flag abnormal tax returns. Make sure you report all of your income to the IRS, including investment...

Read More »

Payoffs for $2 Win Bets ODDS PAYS ODDS 1-5 $2.40 8-5 2-5 $2.80 9-5 1-2 $3.00 2-1 3-5 $3.20 5-2 5 more rows • Nov 4, 2019

Read More »Through December 31, 2023, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19. Buying a multi-unit property can be a great way to earn income whether you're an investor or an owner-occupant who plans to live on-site. You can rent to tenants to help you pay your mortgage, renovate the units and sell the building at a higher price, or rent out all the units (and live elsewhere) to earn ongoing passive income. If you plan to finance your purchase, your credit will impact your options. The credit score needed to buy a multi-unit property can vary depending on whether you plan to live on-site, which type of loan you want and can qualify for, and your down payment amount. What Is the Minimum Credit Score to Get a Multi-Unit Property Mortgage? Properties with up to four units can qualify for a residential mortgage, while those with five or more units are considered commercial real estate. For the purposes of this article, we'll focus on residential mortgages. If you plan to purchase and live in a property with four units or fewer, you may be able to do so using a conventional mortgage loan. This is essentially a loan not affiliated with any government program. To qualify for a conventional multi-family mortgage, you'll likely have to meet the same type of credit requirements as you would on a mortgage for a single-family home. Many lenders require credit scores of 660 or higher for conventional loans, though you may be able to qualify with a score as low as 620. Freddie Mac Home Possible loans—conventional loans for owner-occupants that allow smaller down payments and lower income requirements—require a minimum credit score of 700. Conventional loans are typically the only option available to investors who don't plan to live on-site. Future owner-occupants can also look into government-backed loans. Federal Housing Authority (FHA) loans may be easier to qualify for than most conventional loans, since credit score requirements are lower and the down payment requirement is as little as 3.5% if you purchase four units or less. The Department of Veterans Affairs also offers multi-family mortgages and does not have a minimum credit requirement. The lender you go through for your VA loan, however, may have their own requirements for your credit, income and assets. Ways to Finance a Multi-Unit Property Your down payment and other financing costs will depend on the loan type you qualify for. Here's an overview of financing options for a mult-unit property purchase, and some of the terms to expect: Conventional loans : You may be able to get a conventional loan with as little as 3% down, but you'll pay private mortgage insurance (PMI) if you put down less than 20% of the purchase price. Freddie Mac's Home Possible loan, for purchases of up to four units, may require a down payment as low as 5%.

Understand where your money goes Learn where your money is coming from. ... Learn where your money is going. ... Write your bill due dates on a...

Read More »

one ounce As mentioned, a zip is the colloquial term for one ounce, measured in US customary units. There are 16 ounces in a pound, so a zip also...

Read More »: You may be able to get a conventional loan with as little as 3% down, but you'll pay private mortgage insurance (PMI) if you put down less than 20% of the purchase price. Freddie Mac's Home Possible loan, for purchases of up to four units, may require a down payment as low as 5%. FHA loans : The FHA offers residential loans on multi-unit properties of up to four units through approved lenders. While the required down payment may be as low as 3.5%, you'll have to pay mortgage insurance for the life of the loan. : The FHA offers residential loans on multi-unit properties of up to four units through approved lenders. While the required down payment may be as low as 3.5%, you'll have to pay mortgage insurance for the life of the loan. VA loans: If you're a qualifying servicemember, veteran or military spouse, you can use a VA loan to buy a property with up to four units. You won't be required to pay PMI and you may not have to make a down payment. Your lender will determine your closing costs and interest rate. How to Prepare Your Credit to Buy a Multi-Unit Property Because a mortgage is likely the biggest loan you'll take out, ensuring your credit is in good shape before you apply is critical. In fact, it could save you tens of thousands of dollars over the life of the loan. If you're planning to take out a mortgage for a multi-unit property, the first step in preparing your credit is reviewing your credit reports and scores with all three of the national credit bureaus (Experian, TransUnion and Equifax). You can get a free report from all three at AnnualCreditReport.com. You can also get your Experian credit report and credit score for free. Ideally, you'll want to review your credit file at least six to twelve months in advance of shopping for a new loan. If that's not possible, try to give yourself at least a few months to make improvements, since it could take 30 days or more for changes to show up on your reports and impact your scores. Review your credit reports carefully to ensure all the information is accurate. If you find any inaccuracies, dispute them as soon as possible to have the information modified or removed. If your score isn't as high as you'd like, you can take action. Some of the best ways to improve your scores quickly include paying down credit card balances, bringing any past-due accounts up to date, and making all your debt payments on time. Avoid opening any new credit accounts, such as a new credit card or an auto loan, in the months leading up to your mortgage application. Because a mortgage will represent a significant expense, wait until after you've purchased your new property and adjusted to making the on-time payments before seeking new credit. This will not only help your finances, but will also lead lenders to view your application more favorably. Consider getting prequalified for a mortgage to find out generally what you can get in terms of the loan amount and interest rate, and which lender you may want to work with. When you're ready to make an offer on a property, request a preapproval letter from one or more lenders for a more precise idea of rates and terms. Try to submit all of your applications within a 30-day window, which helps you avoid multiple dings to your credit scores.

If the lift, clean, and place rule is in effect, you are allowed to clean your ball on the fairway. However, if you are just playing a standard...

Read More »

All franchises saw their value rise compared to 2021. The Cincinnati Bengals were deemed the least-valuable NFL franchise at US$2.84 billion, which...

Read More »

So, the best way to win at the casino with $20 is to implement a stop-loss limit. This limit can make your $20 feel like $200. Basically, a stop-...

Read More »

What game apps pay you the most? 21 Blitz. Big Buck Hunter. Bingo Clash. Blackout Bingo. Bubble Cash. Bubble Cube 2. Dominoes Gold. Fruit Frenzy....

Read More »