Wager Mage

Wager Mage

Wager Mage

Wager Mage

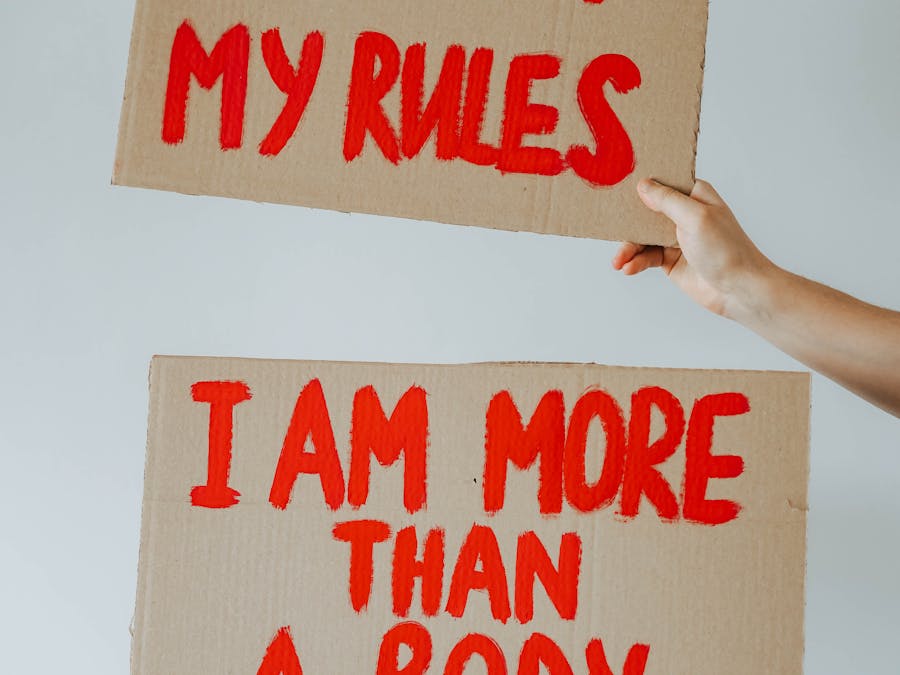

Photo: Karolina Grabowska

Photo: Karolina Grabowska

Z-score indicates how much a given value differs from the standard deviation. The Z-score, or standard score, is the number of standard deviations a given data point lies above or below mean. Standard deviation is essentially a reflection of the amount of variability within a given data set.

The US tech giant and platforms like PayTM and Dream11 have been engaged in a longstanding tussle on the issue. The gambling policies for Google's...

Read More »

With a Short Strangle, you're going to have a little bit higher of a Probability of Profit (POP) on the trade, whereas with a Short Straddle, your...

Read More »

Top 10 best betting sites for cash out 2022 bet365. Spreadex. Betfair. Mansion Bet. William Hill. Paddy Power. BetVictor. Coral. More items...

Read More »

An over 5.5 goals bet is a bet that there will be at least 6 goals in a match. An under 5.5 goals bet means you're predicting that there will be a...

Read More »A Bollinger Band® is a technical indicator used by traders and analysts to assess market volatility based on standard deviation. Simply put, they are a visual representation of the Z-score. For any given price, the number of standard deviations from the mean is reflected by the number of Bollinger Bands between the price and the exponential moving average (EMA).

Most experts — like most people — “are too quick to make up their minds and too slow to change them,” Tetlock says. ... So How Can You Improve Your...

Read More »

Writ of Fieri Facias will expire after seven years from the date of filing with the Clerk's Office.

Read More »

Perhaps part of the answer lies in a seminal paper published in 1956 by the psychologist George A Miller called “The Magical Number Seven, Plus or...

Read More »

Lionel Messi is one of the best dribblers of all time. The unique thing about Messi as opposed to the other players on this list is that he is not...

Read More »